Dollar Swoon Resumes

It appears the greenback resumed its swoon yesterday.

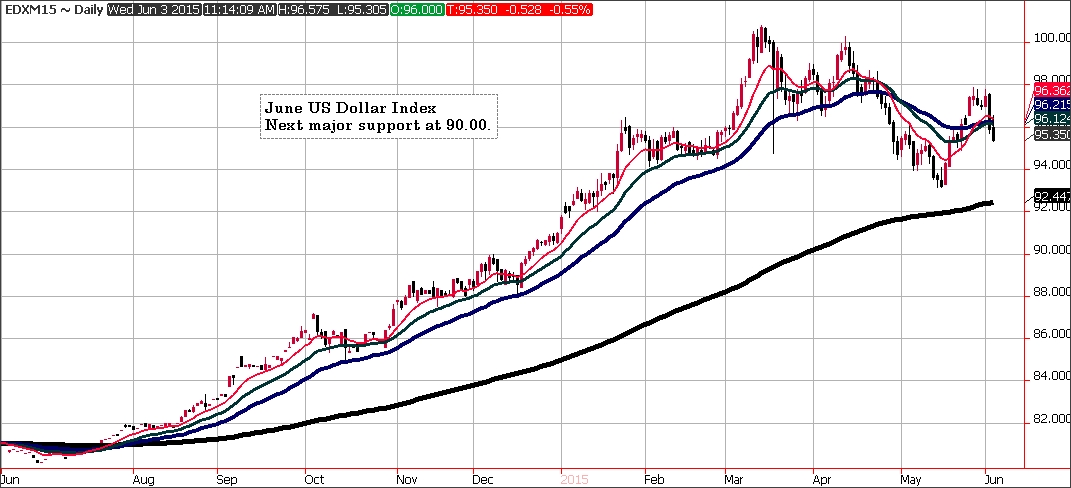

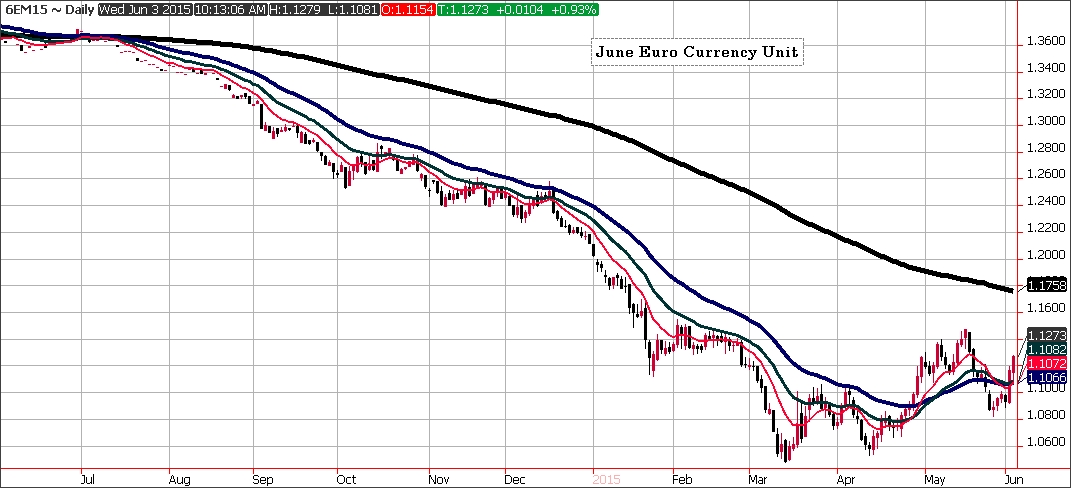

For reference, below are the US Dollar Index; the Euro Currency Unit & Aussie $ charts.

I favor the Euro as it represents over 60% weighting in the US Dollar Index, which makes it a good, high liquidity proxy in trading the buck’s value. The Euro zone has also been trashed for so long and the economic picture has been improving: so much so that investments which went to the United States are now starting to migrate back to Europe (Such is the ebb and flow of monies).

As for the Aussie $, it is undervalued to my eyes (It historically trades around parity with the greenback). Because of the nature of Australian commerce, many consider it the “commodity” currency. It’s probably the closest thing to a commodity index.

I consider limited risk plays against the greenback to be more than mere speculation, I feel it to be a form of insurance in that if the buck were to truly collapse, the ramifications to us all would not necessarily be pleasant. We all want the store of our worth not to lose value.

Regards,

Walt

Walter Otstott

Energies & Metals Markets

Dallas Commodity Company, Inc.

The Colonnade, Building III

15305 Dallas Parkway, Suite 930

Addison, Texas 75001

(972) 387-0080

(972) 387-0018, fax

(214) 537-9750, cell

walter@dallascommodity.com

Guaranteed Introducing Broker to R. J. O’Brien

www.dallascommodity.com

Information herein has been obtained and prepared from sources believed to be reliable; however no guarantee to its accuracy is made. Comments contained in these materials are not intended to be a solicitation to buy or sell any of the commodities mentioned. Past performance is not indicative of future performance results.

This material has been prepared by a sales or trading employee or agent of Dallas Commodity Company, Inc. and is, or is in the nature of, a solicitation. This material is not a research report prepared by Dallas Commodity Company’s Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that Dallas Commodity Company, Inc. believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

« All Posts | ‹ Composition Of The US Dollar Index (USDX) | The Yield Curve ›

This material has been prepared by a sales or trading employee or agent of Dallas Commodity Company and is, or is in the nature of, a solicitation. This material is not a research report prepared by Dallas Commodity Company's Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

The risk of loss in trading commodity futures contracts can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. You may sustain a total loss of the initial margin funds and any additional funds that you deposit with your broker to establish or maintain a position in the commodity futures market.